Tax year of separation

Capital Gains Tax » March 30, 2021

Transfers between divorcing couples can result in high capital gains tax liabilities. It can be beneficial to transfer assets within the tax year of separation due to the capital gains tax rules. In this illustration we look at the difference between transferring assets inside or outside of the tax year of separation.

Gabby & Marcel

Gabby and Marcel married in 2011, they are currently in the process of divorcing. They separated in June 2020 and together they own;

— a matrimonial home in Sussex (capital gain of £350,000)

— an investment property in Bristol (capital gain of £150,000)

Marcel left the family home in July 2020.

Gabby & Marcel have decided that Marcel will transfer the family home to Gabby and Gabby will transfer the investment property to Marcel.

We will look at the tax implications if they complete the transfers before 5April 21 and the implications if the transfers are post 5 April 21.

Transfers before end of the tax year

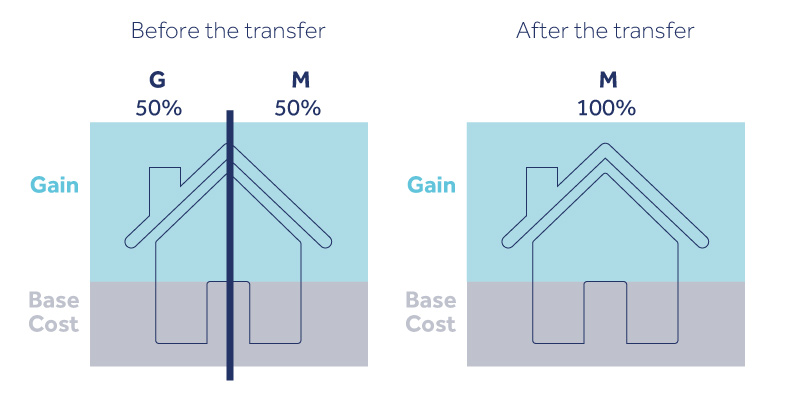

When Gabby and Marcel were married they could transfer assets between themselves with no immediate capital gains tax liability (this is called the no gain no loss principle). When they separated this treatment only continued until the end of the tax year in which they separated.

HMRC defines separation as being ‘separated either by court order or deed of separation, or otherwise in circumstances likely to be permanent.’

As Gabby & Marcel separated in June 2020 they have until 5 April 2021 to benefit from the no gain no loss treatment.

Capital gains tax is assessed when the beneficial ownership (not the legal ownership) changes hands. As it is going to be difficult to remove Gabby from the mortgage, Gabby and Marcel have decided to complete the transfer of beneficial ownership in the tax year and will transfer the mortgage & legal ownership at a later date. They complete the transfers by way of a Deed of Trust.

Consequences

- No reporting requirements

- No immediate tax payable

- Marcel absorbs the latent gain on the investment property

- No CGT implications when the legal ownership is later transferred.

Things to note

- Deed of Trusts need to be correctly executed

- Marcel takes on Gabby’s gain (he will need all of the necessary documents so that he can claim the total allowable expenses when he sells in the future)

Former matrimonial home

As Marcel has been out of the property for 9 months (and before he left the property he lived in it as his main home since ownership) there will be no CGT payable on transfer. This relief applies automatically and does not need to be claimed. This only applies to periods of absence up to 9 months.

Transfers after the end of the tax year

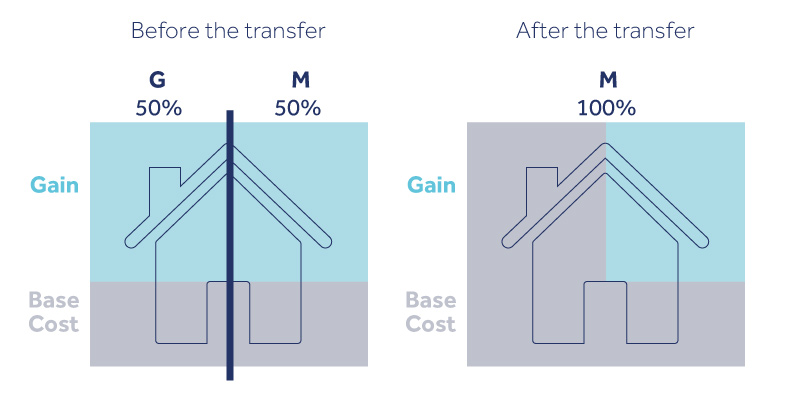

Once the new tax year begins transfers between individuals who are married but separated take place at deemed market value.

Therefore, Gabby is deemed to sell her 50% share of the investment property to Marcel for the market value. Gabby will be assessed to capital gains tax on this transfer. The CGT will be payable within 30 days and she will also need to report the gain to HMRC within 30 days.

Summary

- Transfers between married couples tax place with no immediate CGT payable whilst the couple are married. When the couple separate they have until the end of tax year in which the separation to transfer assets with no immediate CGT payable.

- The new owner of the assets takes on the latent CGT and will pay the CGT liability when they sell the asset in the future.

- After the tax year of separation, transfers take place at market value and usually the transferor will have a CGT liability.

About Juno Family

Juno Family is Charted Tax Advisory firm. We specialise in providing tax advice during separation or matrimonial breakdown. Our Director, Sofia Thomas, is an accredited expert witness, has extensive experience preparing Single Joint Expert reports for the Family Courts & is co-author of Tax Implications on Family Breakdown published by Bloomsbury.

If you would like to instruct us please email us on family@junotax.co.uk.